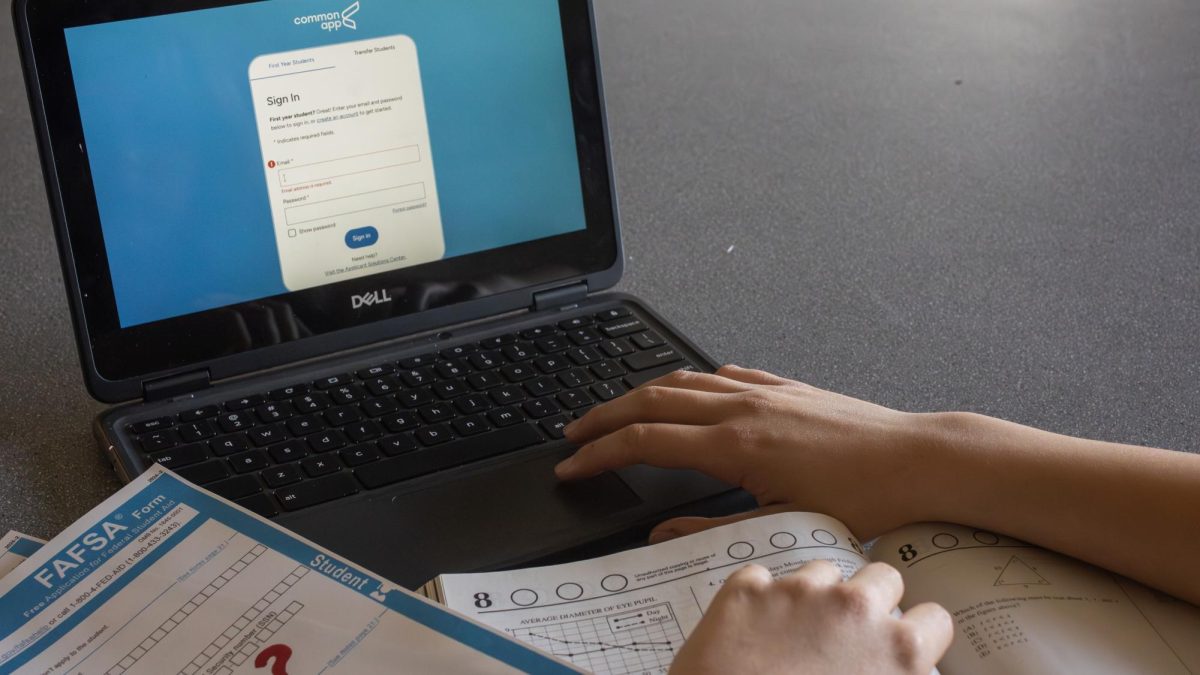

Senior Ruth Godizano stares at their laptop screen in disbelief. The last time they checked their financial aid portal was early January; now, it’s late April, and they finally received a notification — a correction must be made to their form in order to be processed. Frustrated, Godizano shuts their laptop screen. As a prospective first-generation college student with three siblings, receiving financial aid is crucial to their college decision process. With only a week remaining until Godizano’s dream college commitment deadline is up, they are at a crossroads: do they blindly commit, without knowing the potential loans to pay off, or anxiously wait it out, hoping to receive a satisfactory financial aid package until the last second?

For many high school seniors, this year’s financial aid process has been a major headache.

The Free Application for Federal Student Aid (FAFSA) is an annual application that high school seniors complete to be eligible for government loans, grants, and school-based aid. With the redesigned 2024-25 FAFSA reducing the number of questions, the expectation was that the new form would be easier to complete. However, the new and simplified application faced countless missed deadlines and lengthy processing times, causing many students not to receive their award letters until late April — just days before many decisions are due. As a result, many Lowell seniors, such as Godizano, have been harmed rather than helped by the new FAFSA application. In addition, rising seniors have grown worried after witnessing the inefficiencies of the current FAFSA form. Although Lowell College Counselor Maria Aguirre describes navigating this year’s FAFSA as a “hot mess,” she holds out hope that the form will be fixed in time for upcoming high school seniors.

In 2020, Congress passed the FAFSA Simplification Act to ease the process for all undergraduate students seeking financial aid. This would be achieved by paring down the number of questions from 108 to 36 and increasing the amount of income shielded from a formula used to determine aid eligibility — ensuring more students would receive the Pell Grant, a form of aid for undergraduates with exceptional financial need. Reform to its four-decade-old system was also necessary, as the infrastructure underpinning the FAFSA had been deemed among the ten federal systems in most critical need of modernization by the Government Accountability Office in 2019.

The turbulent rollout of the FAFSA form began with miscommunications between Congress and the Department of Education, the agency in charge of carrying out the new form changes. Congress insisted that the new FAFSA form must be available by the 2023-2024 application cycle, but neglected to provide money to make it happen. According to Danielle Gabriel-Douglas, a national higher education news reporter from The Washington Post, the Department of Education promised a new operation to make it easier for everyone. However, the updated application process has been anything but easy. “Contractors have missed deadlines, and people who are in power aren’t always communicating with each other about problems that are arising,” she said. These issues have prompted the delays in the FAFSA aid rollout. In a typical year, the FAFSA form would open in October and be completed by January; however, this year’s application didn’t open until late December, and the Department of Education planned to send data to colleges starting late January. That deadline wasn’t met either, according to Gabriel-Douglas. Thus, only 30 percent of the high school class of 2024 has completed the FAFSA form, a 36 percent drop from the last academic year. At Lowell the completion rate was higher, with school counselor Daniela Alvarado estimating that less than 100 of Lowell’s approximately 660 seniors have yet to complete a financial aid application as of May 2024.

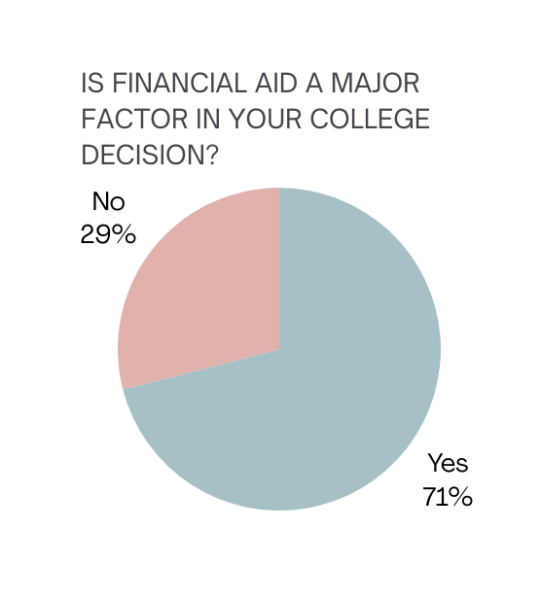

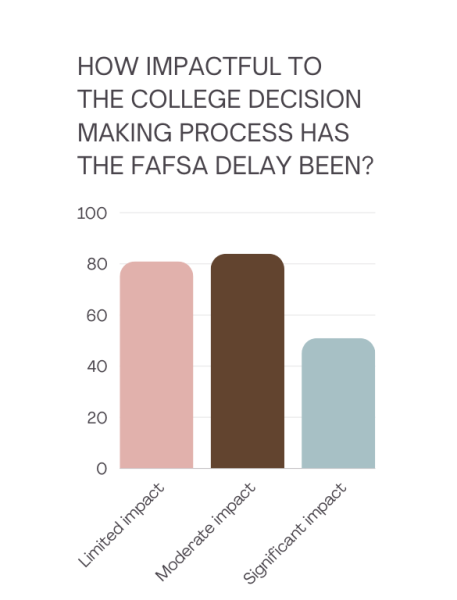

These delays directly impacted colleges’ ability to send financial aid packages to admitted students on time. According to a May 2024 survey conducted by The Lowell of 155 upperclassmen, 70 percent of respondents reported that financial aid is a major factor in their college decision. Additionally, 62 percent of the seniors in the survey reported that FAFSA delays had a moderate to significant impact on their college decisions. Lowell’s College Counselor Maria Aguirre, who has helped many students to submit their FAFSA, believes that the FAFSA delay has made the difficult college applications process even more challenging. “[This year’s form] has caused a lot of stress and uncertainty, since students don’t know how much financial aid they’re receiving from certain schools,” Aguirre said. For Godizano, not receiving enough financial aid would force them to reconsider attending their top choice school. “I wouldn’t want to commit to a school without knowing how much aid I’ll receive,” they said. “If I’m set on one school and can’t afford to go, I would probably go to a backup school like City College.” Although the school they would like to attend extended their priority deadlines, Godizano still found it challenging to make a decision. “There’s not really a proper grace period when submitting your FAFSA versus when coming into your school,” they said.

Technical problems on the form compounded the already frustrating situation. Students with unique family structures and circumstances, like senior Fin Hunter-Kenney, received misleading information on how his unmarried parents could complete the form, leading to his delayed retrieval of student aid awards. “The form said we were missing a signature, but the box to submit a signature was grayed out, so we couldn’t,” Hunter-Kenney said. Hunter-Kenney did not receive the aid packages until late April, and had been growing worried. “Since it took so long to complete, it pushed me right up against the deadline for accepting, which was stressful,” he said. The FAFSA website currently has 19 technical issues left unresolved out of 37 overall documented problems. According to Gabriel-Douglas, errors in student submissions caused by glitches meant many forms weren’t successfully completed until April. “There was a huge gap between the number of submissions and completions, larger than we’ve seen in past cycles,” she said. “In a normal cycle, students are able to make a correction [to these glitches] within one to three days. This time around, you couldn’t make corrections until mid-April.”

Another drawback of the new FAFSA was its diminished consideration for students with siblings also attending college. “For people who have two or more students in college, there used to be a bit of a discount. That’s gone away,” Gabriel-Douglas said. Entering the college application process, Godizano was concerned about burdening their parents with excessive financial expenses when their younger siblings attend college. Now that the FAFSA has been redesigned to provide significantly less aid to students who will be in Godizano’s position, they are worried for the future. “It’s really important that I’m able to get FAFSA because my parents are trying to allocate money evenly through everyone’s education,” they said. “Without FAFSA, it’ll be hard for me to not only provide an example for them but also to just get through college without being in a lot of debt.”

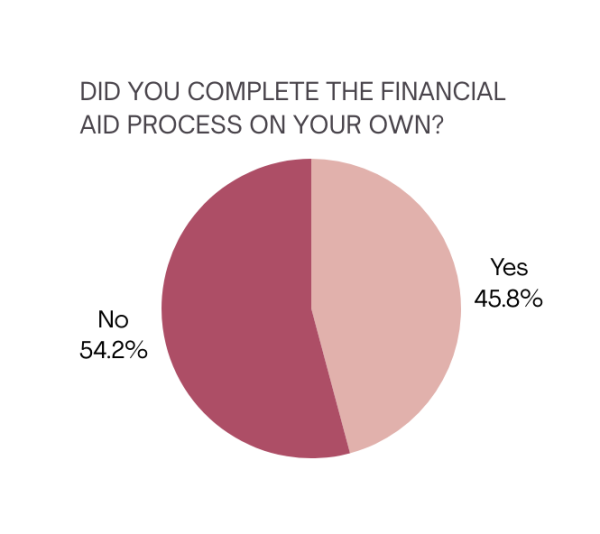

As many Lowell seniors complete the FAFSA independently, they face additional pressure on top of the form’s inefficiencies. The Lowell’s survey found that 46 percent of seniors navigated the financial aid process on their own, with many completing the portions usually intended for parents to fill out. Aguirre’s observations confirm this occurrence. “Parents may be busy or not be tech-savvy, so students may pretend to be them and submit their FAFSA,” Aguirre said. Godizano, who is handling the process alone, believes the lack of customer service or support from FAFSA exacerbated the problems they encountered. Godizano found the process of making a correction especially stressful given the deadlines to commit to schools. “It’s really hard to know how FAFSA will respond to a certain correction or mistake or even a circumstance, and the helpline takes super long, making it really stressful,” they said.

After observing the difficulties seniors face during this financial aid cycle, underclassman students like sophomore Reggie Fong feel anxious about beginning their college application process. “Not only do I have to worry about getting into colleges, I have to also worry about the financial part now, and if I can even go to these colleges,” Fong said. Fong has learned to understand the gravity of financial aid by seeing his older siblings and parents struggle to navigate the new FAFSA form. Similar to Godizano, he fears the financial burden on his parents when he and his siblings attend college simultaneously. “I think it’s just a stressful time in general, so the financial part adds to the already complicated process of getting into college,” he said. In the case of problems arising in the next cycle, Gabriel-Douglas advises that rising seniors be patient and mindful when submitting the form. “Any error that you come across, be quick to report it,” she said.

For some seniors, the new FAFSA wasn’t all that challenging. In contrast to other seniors, senior Audrey Chiang is not heavily reliant on financial aid in her college-decision process. Chiang, who was assisted by her dad, filled out the application in less than a day. Having seen her older brother navigate the previous form, she views the simplified version as an improvement. “This year was a lot easier since it was shorter than it was last year,” she said, recalling the frustration her dad faced when assisting her brother with the previous form. To her benefit, the new form allowed for a quick turnaround of college award letters. “I didn’t really experience delays, everything was pretty smooth. My financial aid package actually came back all in the span of like a month,” Chiang said.

Still, Hunter-Kenney and Godizano hope that improvements to the new system are enacted to reduce the stress for future applicants. Godizano believes that providing more support is essential to set future applicants up for success. “I know that I’m not the only one that has questions, there’s thousands of students,” Godizano said. “Being able to talk to an actual person from FAFSA, rather than a robot that kinda prevents you from getting helpful advice, [would improve the] experience.” Hunter-Kenney hopes that technical issues will be addressed so others don’t experience the errors he faced. “They need to make the form a bit easier for different family statuses, and fix bugs so we’re able to sign where we need to,” he said.

Despite this year’s challenges, Aguirre and Gabriel-Douglas remain optimistic about the new FAFSA form in the long run. According to Aguirre, the new form will ensure that students receive all the aid they qualify for. “[The new system] doesn’t leave a lot of room for error, so the student’s financial aid would be [completed] correctly,” Aguirre said. “I’m hopeful. I see the idea behind it, the purpose of making the change, and I’m hopeful that next year will be better.” By the time the next FAFSA cycle opens up on October 1, 2024, Gabriel-Douglas believes more attention will be given to the form to prevent the same problems from occurring once again. “I think the Department [of Education] has learned a lot,” she said. “One of the silver linings of this is that Congress is paying more attention to how this is unfolding, and I hope that means that they’ll be quick to act when the Department of Education brings changes to them.”

This year’s new FAFSA has proved stressful, complicated, and frustrating due to endless delays and dozens of technical problems. Fortunately, after a long game of waiting, most seniors have been able to receive their colleges’ financial aid letters. Those who endured a morass of issues due to the form, like Godizano, believe that rising seniors will be well-informed to steer a smoother financial aid retrieval process, but they suggest approaching it proactively. “Definitely start as early as you can, go to the college center with any questions, and re-read each instruction,” they said. “Now that there is more information about [FAFSA], by the time the new seniors start the process, a lot of people should understand the form better.”