Fighting financial illiteracy

“Where do I even start?” junior Tomoko Konami wondered, staring at the mountain of paperwork sitting on her desk. Home from a seven-hour shift at her first part-time job, Konami had decided it was about time to address the seemingly endless pile of tax forms, retirement plans, and similar financial documents she had received on her first day of work. Yet as she started to look through the pages, confusing terms and unknown jargon became muddled in her mind. Konami wondered, What does any of this mean?

Konami, like many teens, wishes she knew more about personal finance.

Across the country, young people struggle with financial literacy, according to the Teachers Insurance and Annuity Association of America (TIAA). While high school programs to teach financial literacy — the ability to understand and apply various financial skills, from budgeting to investing — do exist, fewer than half of all the states require a personal finance class in school. Research has shown that in schools that do implement a personal finance class, teens are more confident in finances and better prepared for the future. Yet for most students in America, this education is not an option.

A lack of financial knowledge is not a new issue, but has become especially prevalent among young people. A 2021 study by the TIAA found that two-thirds of Gen Z adults couldn’t correctly answer more than half of the questions in a financial literacy survey, a significant increase compared to previous generations. Additionally, researchers at the Global Financial Literacy Excellence Center found that the economic impact of the COVID-19 pandemic has increased financial anxiety and stress among Americans. Adding to increases in the cost of living and the cost of college, a new emphasis on financial literacy has come to light.

Although there has been debate over the curriculum’s effectiveness, researchers have found that personal finance classes have aided students in this complicated subject. In particular, a number of new studies have highlighted the positive long-term effects of personal finance education on the financial behavior of young people. For example, a 2020 study from Montana State University found that financial education requirements in schools are directly linked to fewer defaults and higher credit scores among young adults. Furthermore, a 2018 report from the Brookings Institute found that teenage financial literacy is positively correlated with asset accumulation and increased net worth by 25 years old. Along with researchers, students too see the importance of personal finance. Professor Selinger, author of The Missing Link: From College and Career to Beyond and personal finance professor at UC Berkeley, describes the way students line up for his college-level personal finance class. “I have 600 students a semester, and when enrollment starts, in a day the class is full,” he said. “Kids understand, ‘We’ve got to learn about money, we’ve got to do it.’ So providing [financial] education … it’s an absolute requirement.”

Yet across the nation, only 23 states require a high school class in personal finance for graduation, and only nine of those states require it to be a standalone course. In California, the state with the largest number of public school students, education in personal finance is not included in the state standards. The Nation’s Report Card on Financial Literacy through the American Public Education Foundation assigns California a “D” in financial literacy, one of 11 states receiving a “failing grade.” According to Professor Selinger, much of this failure in teaching personal finance comes from a lack of education on the subject at a higher level. “You can only teach what you know, and many teachers don’t know what financial literacy is,” Professor Selinger said. “And that’s because in academia, there is no major in financial literacy. There’s no master’s degree. There’s no PhD. In academia [financial literacy] is not even a subject, and the educational system is built around academia. So if [educators] haven’t learned it … there’s nothing to teach.”

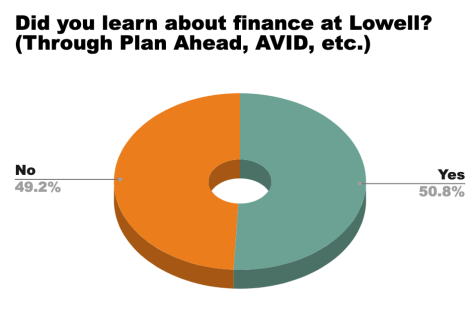

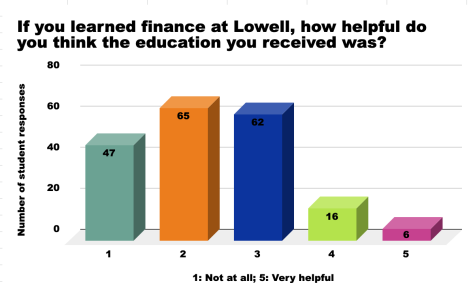

At Lowell, students feel inadequately prepared by the school in the area of personal finance. Lowellites main source of information on financial literacy comes from the mandatory freshman-year Plan Ahead program. Plan Ahead is required in lieu of a traditional semester-long College and Career class, a course focused on preparing students for life beyond high school. At Lowell, Plan Ahead is not a stand-alone class, rather the course is integrated into the overall freshman curriculum. Financial literacy is one of the seven topics taught to students during Plan Ahead, all to be completed within the students’ first semester at the school. However, in a February 2023 survey conducted by The Lowell of 16 randomly selected registries, 57 percent of respondents felt the Plan Ahead curriculum was not helpful in teaching them about personal finance. Many students said that Plan Ahead felt rushed and that they can not remember most of what was taught about finances, especially as they were just getting adjusted to the school while completing the course. “I don’t think freshman year is an effective time to talk about personal finances,” sophomore Jessica Tam said. “When you’re a freshman, finances aren’t your number one priority, so I would most likely forget [what I had learned].”

For Lowell students wishing to learn more about finances, their only other option is through two elective courses, AP Microeconomics and AP Macroeconomics. As described on the College Board website, AP Microeconomics “introduces the principles of economics that apply to the behavior of individuals within an economic system,” and AP Macroeconomics “explores the principles of economics that apply to an economic system as a whole.” While both classes teach about finances on consumer and corporate levels, neither explicitly address personal finance for students. Simply put, a specific class in personal finance does not exist at Lowell.

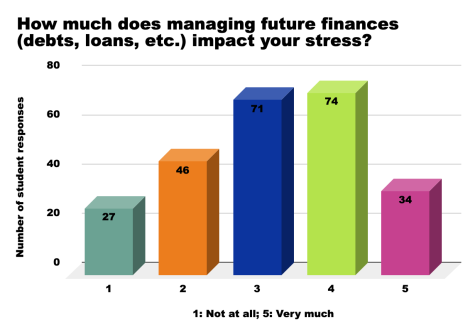

This unpreparedness in making important financial decisions is taking a toll on students’ stress. Seventy two percent of survey respondents said they find the prospect of managing their future finances to negatively impact their stress, especially if they feel unprepared to do so. Students feel concerned and overwhelmed about getting a loan or doing their taxes, and are relying on their parents or outside resources for support. Junior Elise Brooks feels anxious about managing her future finances, even if she has the support system to do so. “[Finances are] always kind of in the back of my mind, like am I going to do this right?” she said. Brooks, like others, also finds her stress is impacted by a lack of financial education from the school. “I think the school fails to educate us in a lot of things that would be really useful in our lives and finances are probably the number one example of that,” she said.

In California, efforts are being made to institute and improve personal finance classes in schools. The American Public Education Foundation advocates for the implementation of a required, stand-alone personal finance class for high school students to strengthen financial literacy in the state. Although this standard has not yet been reached, recent strides have been made to improve the quality of personal finance education in the state. This past August, State Superintendent of Public Instruction Tony Thurmond announced that the California Department of Education had acquired $1.4 million in funding from Next Gen Personal Finance, a California-based nonprofit working to bring financial education to high school students across the country. The funds would allow California high school teachers to receive professional development in teaching financial literacy. This expands on the state’s $3.6 billion Arts, Music, and Instructional Materials Discretionary Block Grant, intended to develop curriculum on a number of subjects, including financial literacy. Assembly Bill 2051, introduced by assemblyman Jordan Cunningham, would also allow the state superintendent to give local school districts funds to develop a financial literacy curriculum. The bill is currently waiting for approval by the Senate.

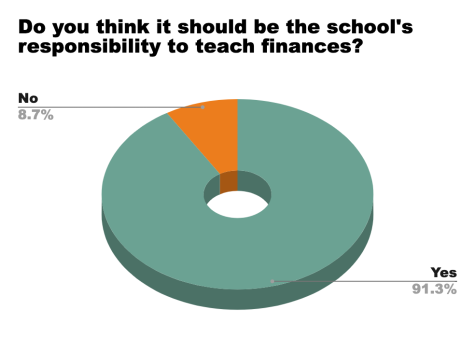

Although the solution seems simple, fitting a new course into the curriculum at Lowell may prove to be a challenge. Many Lowellites have expressed concerns about fitting a separate finance class into their already busy schedules. “There are a lot of other courses we want to take and at a certain point you need to prioritize classes for college over classes that are going to be beneficial in life,” Brooks said. Even so, 91 percent of survey respondents agreed that high schools should be teaching personal finance. Many stated that it is just as or more important than other subjects taught at school. “School’s supposed to prepare you for the world, and that should include learning important life skills,” Konami said. “Algebra 1, Statistics, Geometry — that’s all important if you’re going into STEM — but everyone will need to know how to manage their finances in their adult life. That’s something we need to learn about, too.”

Tatum is a senior at Lowell. Outside of journalism, she can be found browsing the bookstore, struggling through her calculus homework, or listening to a seemingly unhealthy amount of Taylor Swift.

Anita is a junior at Lowell and this is her third year on the publication. She loves Beach House (the band), TV Girl, Barbie films, playing sudoku, and guessing people’s zodiac signs. Outside S108, you can find her snooping in her sister’s closet or running cross country and track.

Elise is a senior. This is her third year as an illustrator for the publication. Some of her interests include petting cats, going to museums, and spending unforgiving amounts of money on the evil coffee monopoly that some may know as Peet's.