Making ends meet

Several Lowellites work part-time jobs and struggle balancing school and work. While some students see working as a measure of independence, others rely on their job for financial stability.

While most teenagers have fun on a Friday night, senior Lisa Lam rushes after class to catch their bus stop, getting ready for a seven-hour work shift. As they reluctantly cancel invitations to hang out, one after the other, Lam feels stripped of a normal teenage life — a life where most people their age don’t have to stress over supporting their family’s expenses with a minimum-wage job.

Lam exemplifies the struggle many employed students at Lowell face as they attempt to find a balance between their academic and economic responsibilities.

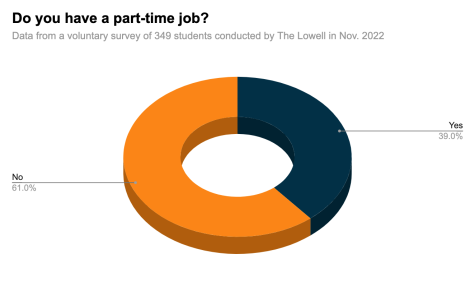

Whether it is serving meals to customers or supervising children after school, many Lowell students have part-time jobs. In an Instagram poll conducted by The Lowell on Nov. 5, 2022, 39 percent of the 349 student respondents identified as being employed. Of these students, several have come forward to share their struggle to prioritize their mental health and other commitments, as well as the learning experiences they have gained along the way.

Since July 1, 2022, San Francisco’s minimum wage for part-time workers has increased to $16.99, an hourly wage that most working high school students receive. Students can find these opportunities from the bulletin board outside of Lowell’s College Center and the school website, according to College Counselor Maria Aguirre. Over the years, many have come to her looking for paid opportunities, as she recalls directing them to apply for internships or even local coffee shop jobs.

These students’ incentives to take on the extra commitment vary on a scale of financial dependence for the wage they earn. On one end, some are not reliant on these commitments to sustain themselves financially, yet are motivated to gain a sense of financial independence. To take some weight off of his mother’s shoulders, junior Nicolas Somma-Tang began working at a Shake Shack restaurant in Downtown San Francisco. Since taking on the role of cooking fries and calling out orders for 15 hours a week, Somma-Tang feels relieved to possess a source of income and the ability to purchase his wants and needs. “I work because I want to buy stuff that I like without feeling guilty,” he said, “For me, money is freedom and having income means I am able to be happy.” Similar to Somma-Tang, working students view employment as an opportunity to have additional pocket money, while also escaping the burden of relying on family members.

Others feel compelled to take on multiple jobs for the sake of aiding their family’s finances. According to the same poll administered by The Lowell, 19 percent of the employed respondents stated they relied on their jobs for financial stability. Clocking in as a cashier at a crepe shop and waitress at a Thai restaurant in San Francisco’s Japantown, Lam works up to 30 hours a week. For Lam, their mother’s gambling addiction and father’s below minimum-wage paying job prompted them to start working during their sophomore year.

Working two back-to-back customer service jobs has not proved to be easy for Lam, who endures heavy strains on their mental and physical health. On weekends when most students their age are catching up on homework assignments or out with friends, Lam is occupied with covering their 11 hour shifts. With no breaks in between, they stand behind a counter for hours on end to serve customers. On top of being worn out after their shifts, Lam admits to receiving little rest. “I don’t get enough sleep, and when I do, I am still very tired from the mental exhaustion of socializing and dealing with rude people,” Lam said.

These impacts of their schedule have also been detrimental to their social life. Lam feels deprived of the leisurely occasions in being around friends since being employed. “I cannot go to many school events or hangout with friends anymore because no one can go to my shifts,” they said. Witnessing the hardships of tirelessly working to provide financial aid to their family, Aguirre is concerned about these students’ mental health. “School is a full-time job too,” she said. “It’s heartbreaking that some students have to feel additional pressure to financially provide for their family.”

Lowell’s rigorous academic environment also serves as a roadblock to students juggling their efforts from school to work. When commuting home after late night shifts, students are then stifled by piles of school assignments that need to be completed. For Somma-Tang, his mother, initially hesitant to allow him to work during the school year, gave him an ultimatum: “‘If you get a B, you have to quit.’” Although Somma-Tang’s part-time job is not a necessity to his family’s financial standing, this additional pressure on working students to perform well in school has taken a toll on them. On the other hand, Lam arrives home past midnight to parents unconcerned about their whereabouts. Currently enrolled in three additional community college classes along with their regular course load at Lowell, Lam finds it difficult to manage their compact schedule. “Being completely honest, I hate it so much,” they said, “It can be exhausting because if I don’t do one day [of school work], it sets me back the entire week.” Lam and Somma-Tang’s ability to remain attentive to assignment deadlines amidst the pressures is a skill they adapted overtime.

As students struggle to sacrifice hours of their time for a minimum wage, they feel that Lowell should provide more thorough courses regarding employment for high school students. Improvements to Lowell’s mandatory Plan Ahead Program would better familiarize students in finding and managing work, according to Lam. The Plan Ahead Program, a one semester long college and career education course for freshman students, aims to build their knowledge and confidence in school, as well as into adulthood. Students often overlook the provided lessons on time-management or resumé-building, as its self-paced and asynchronous nature of learning enables them to simply skim over the contents. “It was really rushed,” Lam said, “I feel like there’s a lot more they could do to help.” With the prevalence of students to financially rely on their work, school resources’s lack of accommodation to students like Lam, leave many clueless and desperate for paid opportunities.

After a hectic night’s shift, these teenagers can be found on their bus ride home, reflecting the hours they have worked and the school assignments to be completed. Most students, unreliant on work for financial stability, simply seek the independence and freedom of purchasing their own belongings. While many others, like Lam, count on the little wages they earn to support their family and make ends meet. Despite accumulating real-world experiences from being employed young, the hours and effort put into working has taken a toll on students’ abilities to lead normal-unoccupied lives. Before students accept a job offer as a tutor or a food server, Lam advises teenagers to think twice about the stakes of being employed young. “We are too young to be working,” they said, “We should be enjoying our teenage lives.”

Sierra is a senior at Lowell. She loves munching on school lunch hotdogs and updating her secret Letterboxd account. Sierra also loves sunny weather.

Ava is a senior at Lowell. When not taking photos, she can be found reading, writing, or listening to her carefully curated playlists when she should probably be doing her homework. Ava also likes thrifting, drinking green tea, and watching Greta Gerwig movies.

jordan • Jan 20, 2023 at 2:30 pm

hi